Lessors require lessee to insurance the equipment being leased. They may further require lessee to purchase life insurance or property damage insurance (called optional insurance). Lessee can buy these insurances from market or ask lessor to provide. Based on who is providing the insurance, it can be categories into two parts:

- Third Party Insurance: Lessee is taking the insurance from third parties, not from lessor

- Lessor provided insurance: Lessor is providing the lease and optional insurances.

Third Party Insurance

When lessee takes insurance on their own, they have to provide the proof of the insurance to lessor. This details is captured during authoring of the contract on the contract header. The details can also be updated after contract is booked through lease center.

OLFM treats third party insurance on the contract level. That means only one policy is allowed per contract irrespective of number of assets. The policy has affectivity duration; after the policy expires, lessee has to provide a fresh insurance policy for the remaining duration of the contract.

The following details are captured for the third party insurance:

| Policy Number |

| Covered Amount |

| Endorsement Field |

| Deductible |

| Name of Insured |

| Proof Due Date |

| Proof Provided Date |

| Effective From |

| Effective To |

| Insurance Company |

| Insurance Company Address |

| Agent Name |

| Agent Address |

When authoring a Contract, third Party Insurance can be captured at header level as follows:

From Lease center agent, the third party insurance can be captured from Insurance tab:

Lessor Provided Insurance

A lessor can provide the following types of insurance:

- Lease Policy: Policies covering the insurance for the equipment.

- Optional Policy: Life insurance policy and Property damage insurance policy

Since the lessor themselves do not provide the policies, they tie with insurance providers to offer the policy to lessees.

Insurance process in OLFM involves the following:

- Create the Required Setups for Insurance

- Create an Insurance Quote

- Accept the Quote and create the Insurance Policy

- Activate the Insurance Policy

Insurance Setup

To provide lease and optional insurance, the following setups are required to be done:

- Define Insurance Inventory Item

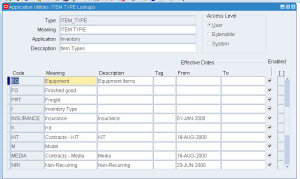

a. Define a new entry under ITEM_TYPE lookup in Inventory

2. Create an inventory item using this item type

3. Associate this item to profile option.

- Define Insurance Providers

The insurance providers are created as vendors; there must be at least one site defined for each insurance vendor. The vendor site is used for sending credits and payments on the lease insurance. The insurance provider defined as supplier have a type of ‘Insurer’.

- Define Insurance Products

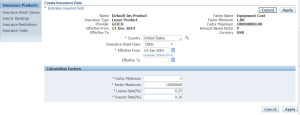

Insurance products are defined in OLFM under Lease Super User => Risk Management => Insurance Products tab.

Insurance product is given a name, Insurance Type (Lease or Optional Product), Inventory Product, Provider, and effective from.

When Insurance type is chosen as Lease Product, the factor name defaults to Equipment cost. When insurance type is chosen as Optional product, the factor name defaults to Age. In both cases, factor minimum and factor maximum need to be specified. Factor min and factor max specifies the range of factor (age or Equipment cost) for which this product will be applicable.

- Define Insurance Rates

Once the product is defined, you define insurance rates.

The rates are defined so that they can be made available during creation of lease quote. These rates are used for calculation of insurance premium when quote is created. The rates are based on Insurance Asset Class (discussed later).

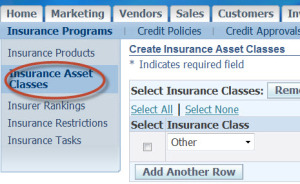

- Define Insurance Asset Class

Different Asset categories are grouped in the asset class. First we create asset class in the lookup type OKL_INSURANCE_ASSET_CLASS and then we associate this class with asset categories. Multiple asset categories can be associated with one asset class. The Insurance asset class is used to determine the insurance rate for an insurance product. For a given insurance product, you could have different insurance rate based on the insurance asset class.

Creating Lease Insurance Quote/Policy

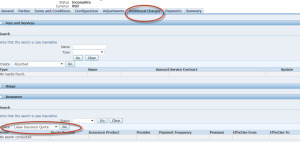

Lease Insurance quote can be created once the setup is complete for Lease insurance. To create lease insurance quote, go to Additional Charges tab under contract authoring.

Once you go to Lease Insurance Quote Screen, you have to enter Insurance product and insurance effective dates. The system will automatically default the insurance provider information and the assets which are covered under the quote. Again since OLFM creates only one policy for all the assets, there will be one quote created for all the assets under the contract. Thus, list of assets associated with the contract will automatically be populated.

Once Quote is created, you have to accept the quote. On acceptance of the quote, quote is changed to policy.

The insurance policy can be manually activated from the Lease Center. Or the insurance policy can be automatically activated when the first premium is paid.

4 Comments

Good stuff thank you kanti

Thank you Sunavi for reading the blog. We appreciate your support.

Hi kanti,

Insurance setups are neatly explained.. good stuff.. thanks kanti..

Setups are neatly explained.. thanks kanti..